- GritALPHA

- Posts

- A Full Analysis of Uber Technologies ($UBER)

A Full Analysis of Uber Technologies ($UBER)

Recent partnerships are powering this platform play.

Together with X Funds

Welcome back to GRIT Alpha! This week, we’re breaking down the company that changed the world of transportation forever. Today, let’s talk about how there’s much more than meets the eye to Uber.

Let’s dive in.

Looking to gain exposure to crypto without the wild swings? The Nicholas Crypto Income ETF (BLOX) offers a unique solution: exposure to the crypto ecosystem and the opportunity for weekly income.

BLOX is designed to provide:

Access to Bitcoin & Ether through ETFs and ETPs

Equity exposure to crypto industry leaders — from miners to DeFi platforms

Weekly income through options strategies on portfolio holdings

Whether you’re crypto-curious or looking to add yield potential to your portfolio, BLOX gives you broad exposure in a single ticker.

👉 Learn more at NicholasX.com/BLOX

Stock Deep Dive: Uber Technologies Inc. (UBER-US, $182B MCAP)

In today’s fast-moving environment, companies must adapt or die.

Whenever a revolutionary technology comes to the market, incumbents need to learn how to change their operations and ask the key question, “How will this disrupt my business model?”

Every company should be asking this now with the proliferation of AI.

We’ve heard a lot about AI’s impact on the productivity suite with the widespread adoption of Large Language Models (LLMs). But all the top dogs in the industry are now pivoting to a new modality… real world models.

This aspect of physical AI will continue to evolve and change everything around us. One of the implementations of this is in the transportation industry through autonomous vehicles.

Tesla, Waymo, and many others are making significant inroads (pun intended) on this technology. But what will this do to existing platforms like Uber?

Uber disrupted the taxi industry, but can it now disrupt itself?

Why now? 👉 Significant Partnerships Bolster Platform

Overview 👉 What Does Uber Do?

How Do They Win? 👉 Value Proposition

How Do They Make Money? 👉 Business Model

Autonomous Ambitions 👉 Riding into the Future

By The Numbers 👉 Key Metrics

Risks 👉 Potential Pitfalls

Why now? 👉 Significant Partnerships Bolster Platform

In mid-2025, Uber finds itself riding a wave of optimism. The stock has surged roughly 50% year-to-date, far outpacing the broader market, and recently hit an all-time high around the mid-$90s per share. This rally reflects Uber’s transformation into a profitable growth story: the company just posted another strong quarter (Q1 2025) with revenue up 14% and over $1.8B in net income, marking a stark turnaround from losses a year ago. Crucially, management is signaling that Uber’s core business is not only growing but growing profitably, generating $2.3B in free cash flow last quarter.

Investors are also excited about Uber’s moves to future-proof its platform. In the span of just a few months, Uber announced a flurry of strategic partnerships in autonomous vehicles, teaming up with leading self-driving tech companies to put their robotaxis on Uber’s network. From Waymo’s driverless cars in Phoenix and Austin to new deals with Lucid Motors/Nuro and May Mobility, these alliances bolster Uber’s platform by ensuring it will have ample cutting-edge supply in the coming years.

As CEO Dara Khosrowshahi put it, Uber is leveraging the “massive opportunity” of autonomy and enters 2025 with “clear momentum” across its priorities. In other words, why now is so pivotal for Uber comes down to this: after years of volatility, Uber has achieved an inflection point of platform scale and improving economics. It’s executing on a plan to convert its ride-hailing dominance into sustained financial strength, all while turning potential disruptors (autonomous cars) into collaborators. Dominant network effects + newfound profit discipline = a company in the driver’s seat.

Overview 👉 What Does Uber Do?

Uber Technologies is a global tech platform connecting people to on-demand transportation, food delivery, and freight. Founded in 2009 and launching its app in 2010, it now operates in about 70 countries and 10,000+ cities. Best known for ride-hailing, Uber’s ecosystem includes:

Mobility (Rideshare): Matching riders with drivers (plus scooters or taxis in some markets), redefining urban travel.

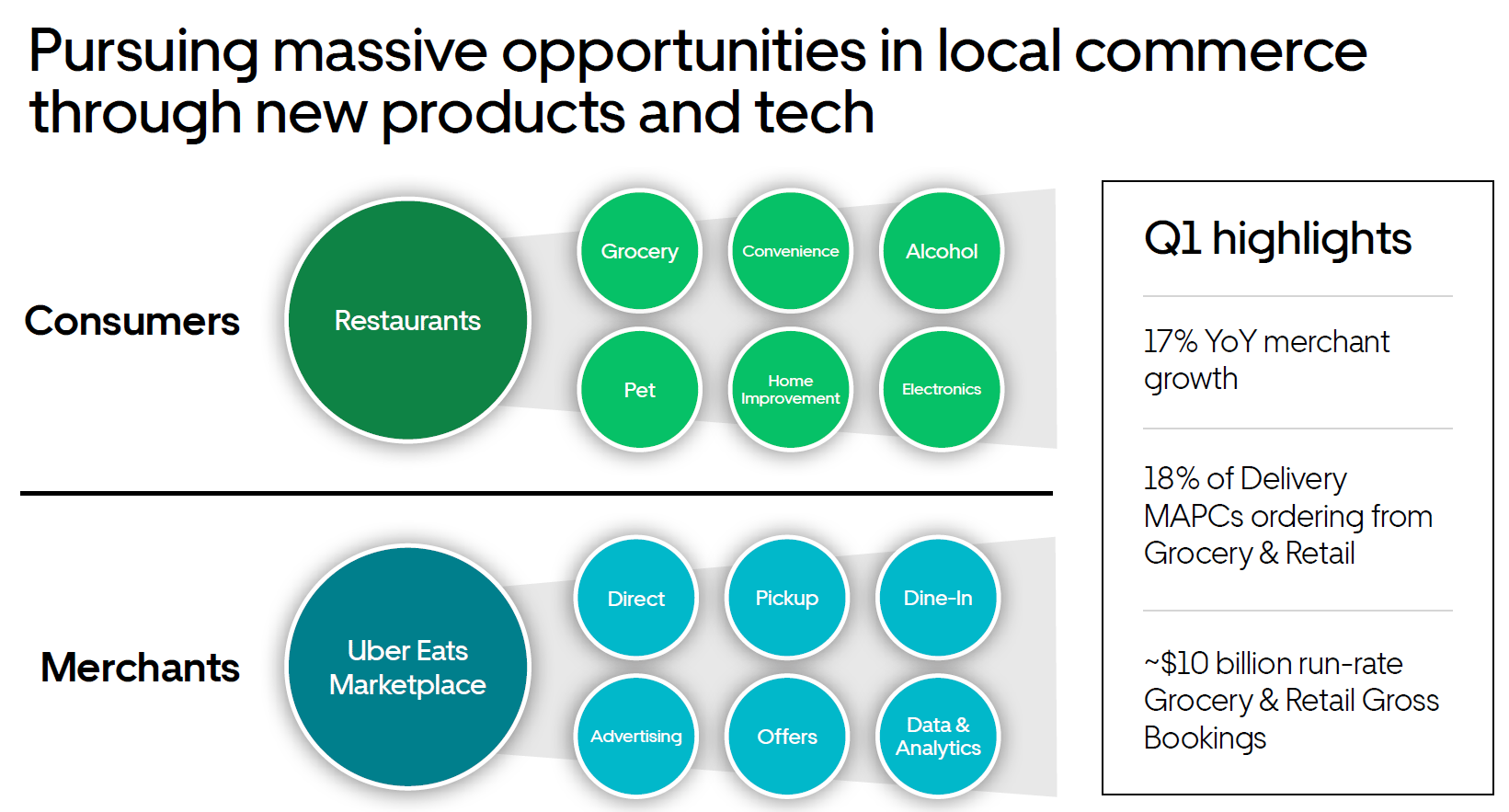

Delivery (Uber Eats and more): Ordering food—and increasingly groceries, alcohol, and other goods—for courier delivery. Launched in 2015, Uber Eats is a heavyweight alongside DoorDash.

Source: Company Filings

Freight: A B2B marketplace pairing shippers with truckers, using Uber’s tech stack to book and move loads (still a smaller segment).

Other services: Uber for Business, Uber Health, and niche offerings like Uber Boat or charters.

All of it runs on a massive two-sided marketplace linking consumers (riders, eaters, shippers) with providers (drivers, couriers, carriers). As of early 2025, Uber serves roughly 170 million monthly active consumers and powers about 3 billion trips per quarter. Cumulatively, it has facilitated over 60 billion trips. The mission, “to move people, food, and things and open up the world to new possibilities,” captures its evolution from a ride-hailing app into a broad movement platform. Uber uses technology to make transportation and delivery ultra-convenient, charging a fee to orchestrate those services and embedding itself in the modern urban economy.

How Do They Win? 👉 Value Proposition

Uber’s edge is its network flywheel: more drivers mean faster pickups and wider coverage, which attracts more riders; that demand gives drivers steady fares, pulling in even more supply. Smaller rivals can’t easily match that density, so riders can tap the app almost anywhere and get a car in minutes.

Its multi-service ecosystem deepens lock-in. The same app that gets you to the airport can deliver dinner or groceries. Uber One (now ~30 million members) offers free delivery and ride discounts; those members generate roughly 30% of bookings and spend several times more than non-members. Cross-selling rides and Eats boosts frequency and loyalty.

Brand and convenience matter, too. “Calling an Uber” is shorthand for getting a ride. The clean UX, upfront pricing, cashless payment, ratings, all reset expectations versus taxis. Drivers gain flexible work, restaurants gain access to a huge customer base, and riders get quick, often cheaper service: a three-sided marketplace where each side benefits from scale.

Under the hood, Uber’s data and algorithms match supply/demand in real time, set dynamic prices, optimize routes, and continually refine ETAs off billions of trips. Newer, high-margin layers like in-app advertising add monetization without heavy costs.

Strategically, Uber partners on autonomy instead of building cars itself, aiming to stay the default marketplace no matter who perfects self-driving. Uber wins by being the biggest, most convenient, and most versatile platform. Scale, data, and a growing services stack form a moat that’s hard to breach.

How Do They Make Money? 👉 Business Model

Uber’s engine is a take rate on every transaction. On rides or Eats orders, it keeps roughly 20 to 30% plus various service or booking fees.

Mobility: Ride-hailing is the biggest, highest-margin piece. Q1 2025 gross bookings were about $23B, with adjusted EBITDA margins above 8%.

Delivery: Eats and newer verticals charge consumers fees and merchants commissions. Bookings were roughly $20B per quarter in late 2024. Margins have flipped positive (about 3–4%) as scale, batching, and grocery help unit economics.

Freight: A digital broker that clips a fee per load. Around $1.3B revenue per quarter, near break-even while Uber pushes efficiency and volume.

Subscriptions & other: Uber One (~$9.99/month or $99/year) adds recurring revenue and boosts retention; members drive a disproportionate share of bookings. Advertising is a fast-growing, high-margin layer, running at roughly $1.5B annualized by Q1 2025. Miscellaneous partnerships and tech licensing are smaller.

The model is asset-light: drivers and couriers supply vehicles; Uber supplies software, support, and demand. Scale spreads fixed platform costs, so rising volume drops more to profit. In Q1 2025, $42.8B in gross bookings translated to $11.5B in revenue after payouts. The focus now is disciplined, profitable growth through optimizing commissions, fees, and new monetization levers to sustain cash generation.

Autonomous Ambitions 👉 Riding into the Future

Source: Company Website