- GritALPHA

- Posts

- A Full Analysis of TeraWulf ($WULF)

A Full Analysis of TeraWulf ($WULF)

It's time to focus on the bottlenecks...

Together with Quantify Funds

Welcome to the first Grit Alpha post of 2026! Today, we’ll be diving into a stock that’s quietly up +175% over the last six months…

Stock Pick: Terawulf Inc. (WULF-US, $5.5B MCAP)

Everyone building AI says the same thing.

Power is the bottleneck. We know this.

But the real constraint today is not total generation. It’s grid access now. Interconnection queues, substation lead times, and permitting have turned “time-to-power” into the scarcest input in AI infrastructure.

That’s where this week’s pick comes in.

TeraWulf is not an AI software story. It’s a power connection story. The company controls legacy-connected sites and is converting that advantage into long-duration AI hosting contracts. In a market where “ready now” megawatts can command a premium, WULF is positioned to monetize the bottleneck.

With AI names off their highs, this can be an attractive way to express the view that grid constraints persist and the market will keep rewarding on-time capacity.

Why Now? 👉 Surging AI Demand Meets Grid Bottlenecks

Overview 👉 What Does TeraWulf Do?

Role in Ecosystem 👉 Power Bottlenecks in the AI Infrastructure Race

How Do They Win? 👉 WULF’s Strategic Edge in Power Contracting

Business Units 👉 Facilities and Operating Segments

How Do They Make Money? 👉 Revenue Drivers and Cost Advantages

By The Numbers 👉 Key Metrics

Competition and Outlook 👉 AI Miners vs Traditional Miners

Risks 👉 Potential Pitfalls

Bonus Section 👉 Google Partnership and Infrastructure Implications

Inflation Hedge - Potentially Preserves Purchasing Power

Currency Debasement Hedge - Bitcoin & Gold Scarcity Profile

Fiscal Dominance Hedge - Rising Deficits and Debts

Gold as a Potential Bitcoin Volatility Buffer - Correlation Benefits

Return Stacking - Addition Without Subtraction

Governments and central banks can’t print Bitcoin or Gold. The U.S. left the gold standard in 1971. Since then, the world has leveraged almost every asset imaginable.

The likely outcome of a future recession is even more printing.

Why Now? 👉 Surging AI Demand Meets Grid Bottlenecks

AI infrastructure is running into a hard constraint that money and chips cannot instantly solve: available power and grid interconnections. Training and serving frontier models requires dense GPU clusters, but many new data center projects face multi-year timelines for substations, transmission upgrades, and permits. With a projected U.S. data center power shortfall through 2028, “megawatts” have become a scarce input, not an afterthought.

That scarcity is creating a window for a specific group of fast movers: Bitcoin miners with existing power-heavy campuses and proven operating capability at industrial load. Post-halving, miners’ economics became more fragile, pushing the industry to find higher value workloads than pure Bitcoin production. AI and HPC hosting is the obvious adjacent market because it monetizes the same core asset: contracted power plus data center infrastructure.

TeraWulf (WULF) is leaning into this pivot aggressively. Management is effectively treating power as the moat, aiming to convert advantaged sites into long-duration, contracted AI revenues. If the AI buildout remains power constrained, platforms that can deliver shovel-ready megawatts should command premium economics and tighter financing terms versus greenfield developers stuck in interconnection queues.

Overview 👉 What Does TeraWulf Do?

TeraWulf is transitioning from a Bitcoin miner into a hybrid digital infrastructure company that develops and operates large-scale U.S. campuses for both Bitcoin mining and AI-focused high-performance computing hosting. The company’s positioning emphasizes low-carbon power supply, power cost control, and the ability to deliver high-density data halls that meet modern AI requirements.

Operationally, WULF runs flagship sites in New York and is expanding into Texas. It has historically operated around 7 to 12 EH/s of Bitcoin hash rate, but the strategic priority has shifted toward leasing capacity to AI customers under long-term agreements. The company began generating recurring HPC hosting revenue in 2025, marking the start of a more contracted, infrastructure-like earnings profile.

The differentiator WULF highlights is energy integration. Instead of simply renting generic warehouse space, it focuses on siting at locations with legacy grid connectivity, securing long-term power arrangements, and investing in substations and related infrastructure to support large loads. Financially, mining remains meaningful near term, but the company has signed more than $17B of hosting contracts, indicating an intent to re-rate toward a contracted cash flow model rather than a pure crypto beta.

Role in Ecosystem 👉 Power Bottlenecks in the AI Infrastructure Race

In the AI compute stack, TeraWulf sits at the physical layer where the actual constraint resides: land, power, and data center delivery. Model developers and cloud platforms can source GPUs, software, and capital, but they cannot accelerate grid interconnection timelines by writing bigger checks. Power delivery and permitting have become the pacing items, often stretching 2 to 5+ years for large projects.

Source: Company Filings

WULF’s relevance comes from compressing that timeline. Its strategy is to repurpose industrial sites with existing high-voltage infrastructure, effectively “recycling” legacy interconnections into AI-ready campuses. Lake Mariner in New York is the template: a former coal plant site with robust transmission feeds and substation capabilities that can support large incremental load without waiting years for new transmission buildouts. The Cayuga site follows the same playbook, using a long-duration lease on a former plant property to access meaningful power potential.

In practice, WULF serves as a bridge between utilities and AI operators. It provides ready-to-energize capacity, engineered for high-density workloads, while aligning with customers’ sustainability goals through a largely low-carbon power mix. The value proposition is speed, scale, and power availability, which is exactly what the market is short of.

How Do They Win? 👉 WULF’s Strategic Edge in Power Contracting

WULF’s edge is built around securing, de-risking, and monetizing power. First, it targets low all-in power costs, aiming for roughly $0.045 per kWh at Lake Mariner, which improves unit economics for both mining and hosting. Second, it seeks long-duration power arrangements and operational flexibility, using energy-market know-how to reduce net power costs through curtailment and demand response when economics warrant.

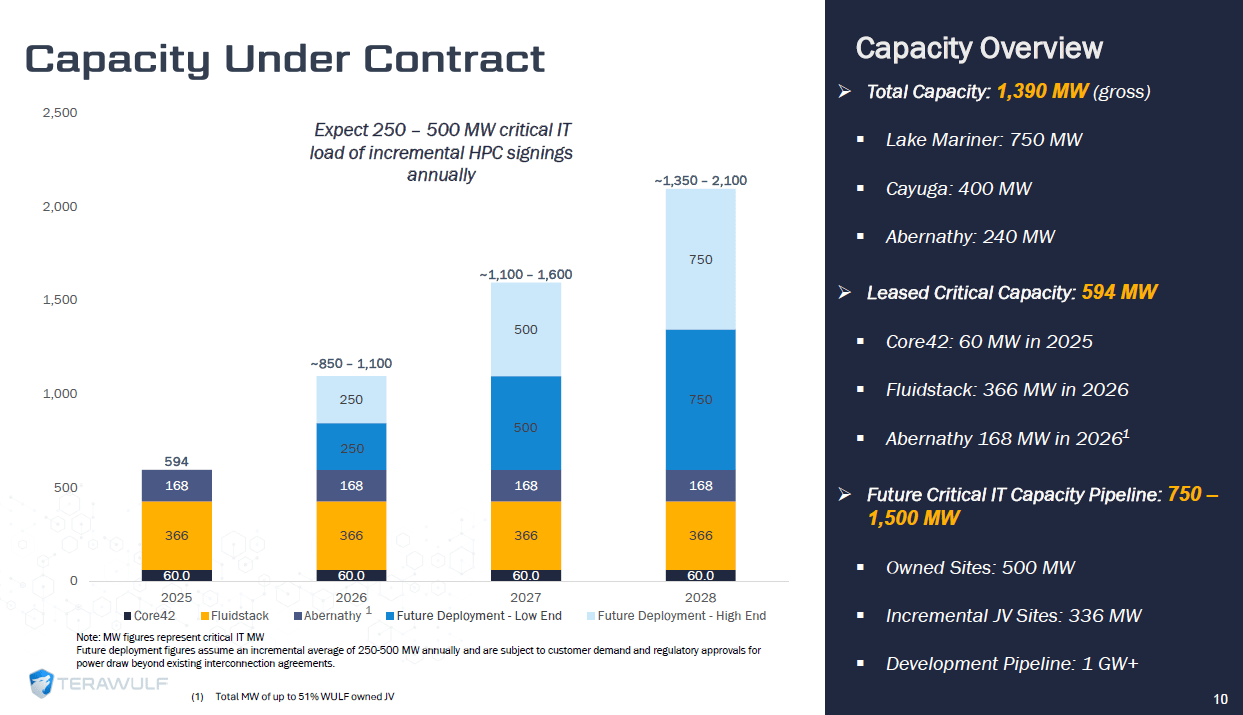

Third, WULF focuses on “advantaged infrastructure positions” where grid connectivity already exists at scale. This avoids the capital and time burden of creating new interconnections and can support faster delivery schedules, which is a key differentiator in a constrained market. Fourth, it structures expansion optionality into sites and contracts. Examples include incremental MW expansion rights for customers and multi-phase development plans that convert future capacity into a pipeline of contracted growth.

Finally, WULF has pioneered a financing and partnership model that improves bankability. The company’s relationship with Google is not about technical compute services but about credit enhancement and alignment. By pairing long-term leases with investment-grade style backstops and equity-linked warrants, WULF improves financing terms for large buildouts and increases the probability of delivering projects at scale. The “how they win” is simple: deliver megawatts when others cannot, with better power economics and stronger credit structure.

Business Units 👉 Facilities and Operating Segments

WULF’s operating footprint is organized around three major sites and two core activities: Bitcoin self-mining and HPC hosting.

Lake Mariner (New York) is the flagship. It is a repurposed industrial site with up to 750 MW potential at full buildout. It currently supports both mining and hosting, with mining load reduced as hosting ramps. The campus includes multiple purpose-built buildings designed for high-density compute, with strong grid connectivity and a low-carbon regional power mix that appeals to hyperscale customers. Lake Mariner anchors signed hosting activity, including large multi-phase commitments.

Source: Company Filings

Lake Hawkeye, also referred to as the Cayuga campus (New York), is the expansion platform. It is an 80-year lease on a former plant site with up to 400 MW potential. The development plan targets a staged ramp of HPC capacity, positioning the site as a second engine of contracted growth as Lake Mariner fills.

Abernathy (Texas) is a 51% owned joint venture with Fluidstack, backed by long-term lease commitments and a credit enhancement structure. The first 168 MW phase is targeted for delivery in 2H 2026 with expansion rights.

Segment-wise, Bitcoin mining provides near-term revenue volatility, while hosting is designed to become the dominant, contracted cash flow stream.

How Do They Make Money? 👉 Revenue Drivers and Cost Advantages

WULF’s revenue model is migrating from commodity-like Bitcoin mining to infrastructure-like hosting. Mining generates revenue from BTC earned through hash rate contribution, with realized economics primarily driven by Bitcoin price, network difficulty, and power costs. Post-halving, mining is structurally tougher because the block reward is smaller, raising the importance of low power costs and efficient fleet management. WULF has historically operated at scale, but the company increasingly treats mining as a flexible load that can be dialed up or down based on hosting demand and power market conditions.

The growth engine is HPC hosting. Under long-term agreements, WULF provides powered shells, cooling, physical security, and operational services so customers can deploy GPU clusters. These contracts are typically 10 to 25 years with renewal options, producing recurring cash flows that resemble data center or infrastructure revenue. Hosting should also carry higher margins than mining because customers pay for speed-to-market, secured power capacity, and delivered infrastructure, not only pass-through electricity.

Cost advantages are anchored in power. Target power costs around $0.045 per kWh create meaningful spread versus what HPC customers are effectively willing to pay for delivered capacity. The tradeoff is capital intensity and leverage, as WULF is funding large buildouts upfront and relying on contracted revenue to service debt and generate equity residual value.

Source: Company Filings