- GritALPHA

- Posts

- A Full Analysis of Taiwan Semiconductor ($TSM)

A Full Analysis of Taiwan Semiconductor ($TSM)

Is this a 100% legal monopoly?...

Hi everyone,

Today we’ll be breaking down a massively important company that’s up +159% over the past five years.

Let’s dive into Taiwan Semiconductor Manufacturing Company (TSMC or ticker TSM).

Stock Deep Dive: Taiwan Semiconductor Manufacturing Co. (TSM-US, $1.49T MCAP)

TSMC isn’t just riding the AI boom, it’s manufacturing it.

While Nvidia, AMD, and a wave of chip designers battle for headlines, TSMC sits underneath the entire stack as the factory that turns cutting edge silicon into reality. In 2025, that position is paying off: demand for advanced nodes is surging, AI accelerators are soaking up capacity, and TSMC’s scale and execution are pushing revenue, margins, and investor confidence to rare territory.

This is the ultimate picks and shovels story for next gen computing, where the winner is the company supplying nearly everyone. With 3nm ramping fast, 2nm on deck, and tens of billions flowing into new fabs, TSMC is aiming to translate its process lead into unprecedented financial scale.

The question isn’t whether AI needs more chips. It’s who can deliver them, on time, at volume.

Why Now? 👉 The Silicon Backbone of the AI Boom

Overview 👉 What Does TSMC Do? Role in Tech Ecosystem

How Semiconductors Fit into Modern Tech

How Do They Win? 👉 TSMC’s Value Proposition

Business Units 👉 Segment Breakdown

How Do They Make Money? 👉 TSMC’s Revenue Model

By The Numbers 👉 Key Metrics

Competition and Outlook

Risks 👉 Potential Pitfalls

Wrapping Up…

Why Now? 👉 The Silicon Backbone of the AI Boom

In early 2025, TSMC (NYSE: TSM) is trading near all time highs after a standout Q1 driven by surging demand for leading edge AI chips. Its market cap is approaching the $1T tier, reflecting how central it has become to next gen computing. Shares rose roughly 40% to 50% year on year, outperforming many semiconductor peers as investors treat TSMC as the “picks and shovels” provider for AI. While designers like Nvidia and AMD compete for share, TSMC benefits by manufacturing a large portion of the most in demand silicon across the industry.

Management is reinforcing that optimism with bigger long term goals, pointing to roughly 25% annual revenue growth through the decade. That confidence is backed by a major expansion cycle to add capacity and stay ahead at the most advanced nodes. The setup is simple: AI is pulling forward demand for cutting edge wafers, and TSMC is one of the few companies that can reliably deliver them at scale.

Overview 👉 What Does TSMC Do? Role in Tech Ecosystem

TSMC is the world’s largest contract semiconductor manufacturer, or foundry. Instead of designing chips or selling consumer devices, it manufactures integrated circuits for customers like Apple, Nvidia, AMD, and hundreds of other chip designers. Founded in 1987, TSMC popularized the pure play foundry model, enabling “fabless” companies to innovate in design without owning expensive fabrication plants.

Today it is a linchpin of global tech, with over 60% share of the foundry market and an even larger share at the most advanced process nodes. It is widely viewed as the primary producer of leading edge chips at 7nm and below, powering smartphone processors, GPUs, AI accelerators, PC CPUs, networking silicon, and more. TSMC generated about $90B of revenue in 2024 and runs most of its operations in Taiwan, while expanding its footprint with new sites underway in the U.S. and Japan. In practice, it is the “invisible factory” behind many of the world’s most important electronics.

How Semiconductors Fit into Modern Tech

Semiconductors are the core components that make modern electronics compute, store data, and connect. Phones, laptops, data centers, factory equipment, and cars all rely on chips, and recent supply disruptions showed how quickly whole industries stall when chip supply is constrained. Now demand is being pulled higher by AI, 5G, IoT, and electric vehicles. AI is especially intense because training and running models requires massive compute, typically delivered by GPUs and dedicated AI accelerators built with the newest manufacturing nodes. Those chips pack billions of transistors, so they need the most advanced processes to hit performance and efficiency targets. That is where TSMC matters: it has the manufacturing scale and technical capability to mass produce leading edge silicon that many designers cannot source elsewhere.

In effect, TSMC translates breakthrough chip architectures into physical products, enabling everything from state of the art AI servers to next generation smartphones. If chips are the “fuel” of the digital economy, TSMC is one of the most critical refineries.

How Do They Win? 👉 TSMC’s Value Proposition

TSMC’s moat starts with technology leadership. It led the industry into 7nm, 5nm, and 3nm, and it is targeting 2nm production in 2025. At 3nm and beyond, it holds an estimated ~95% share, driven by superior yields, faster ramps, and proven reliability. That execution record is why top customers trust TSMC with their most valuable designs and product schedules.

The second pillar is scale and focus. TSMC runs a massive network of fabs and can invest roughly $30B to $40B+ per year in capacity and equipment, a level many rivals cannot match. Unlike integrated players, it is fully focused on third party manufacturing and does not compete with customers in end products, reducing conflicts and increasing trust. Its partnership model creates sticky relationships, and its broad customer base across mobile and high performance computing helps smooth cycles. Put together, TSMC offers the most advanced, efficient, and dependable manufacturing platform in the world, and it gets paid premium pricing for it.

Business Units 👉 Segment Breakdown

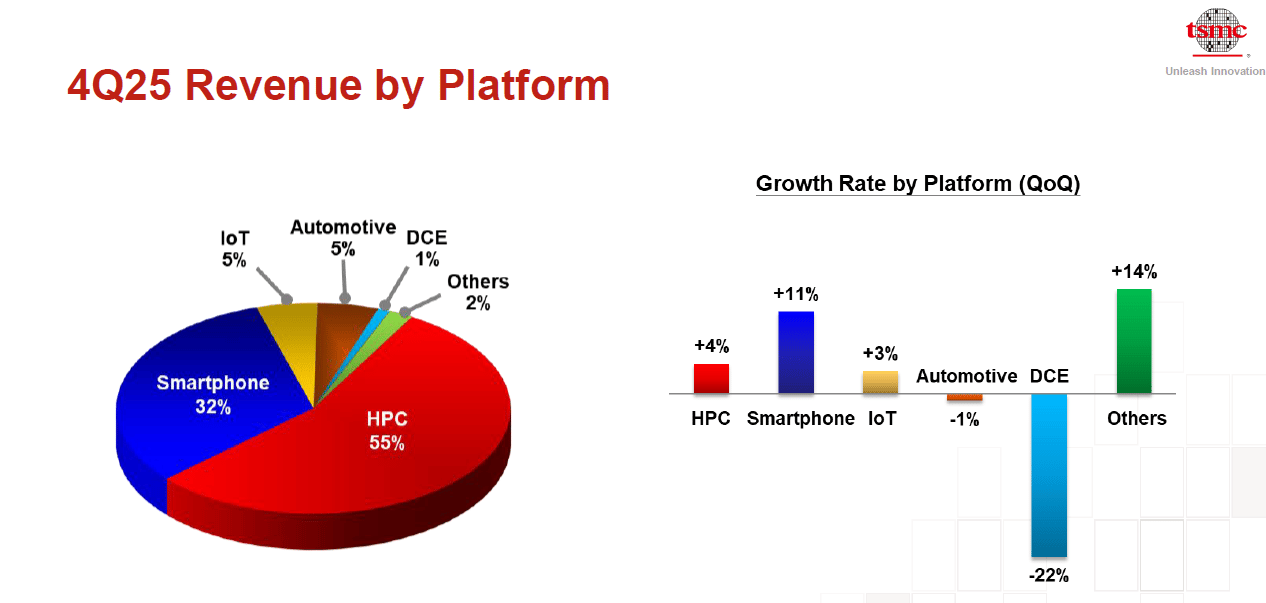

TSMC reports revenue by end market platform, and the mix has shifted sharply toward high performance computing (HPC). HPC, which includes data center CPUs, GPUs, AI accelerators, and gaming related chips, became the largest segment at about 53% of revenue in Q4 2024, while smartphones were about 35%. With AI infrastructure spending accelerating, HPC is expected to keep rising, with estimates that it could approach ~60% of revenue by mid 2025 as AI GPU and servers demand grows.

Source: Company Filings

Smartphones remain substantial, and Apple is still a key customer, contributing about 24% of revenue in 2024 through iPhone, iPad, and Mac processors. However, Nvidia’s fast growing advanced node demand could make it the largest customer in 2025. Beyond HPC and smartphones, TSMC serves IoT, automotive, and digital consumer electronics, each contributing mid single digit shares. Automotive is still only about ~5% today, but it is growing as vehicles add more compute. Overall, TSMC’s mix is increasingly AI and compute heavy, while staying diversified across multiple silicon categories.

How Do They Make Money? 👉 TSMC’s Revenue Model

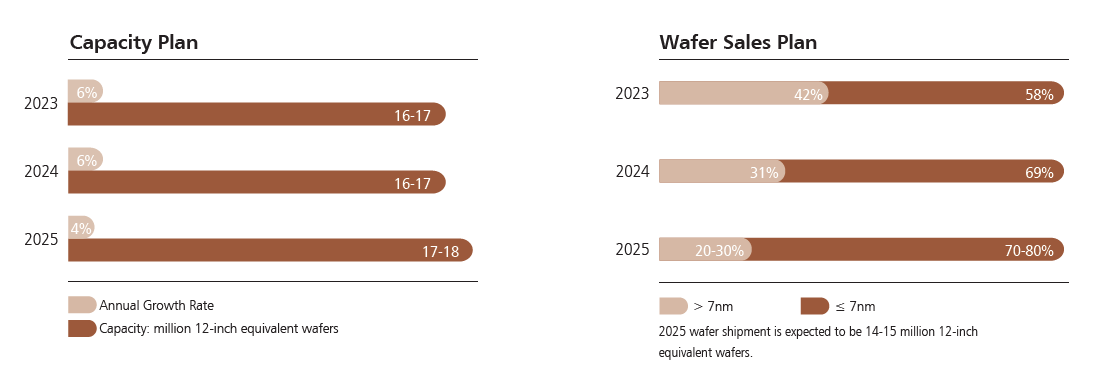

TSMC earns revenue by manufacturing wafers and delivering usable chip output to customers, with pricing often strongest at leading edge nodes where competition is limited. That translates into meaningful pricing power, with industry estimates putting a 2nm wafer around $25K to $30K. The model is capital intensive, but highly profitable when utilization is strong: gross margins commonly run in the 50% to 60% range because TSMC spreads massive fixed costs across huge volume while maintaining high yields. Continuous reinvestment is central.

Source: Company Filings

In 2024 it spent roughly $36B on capex, and it has indicated spending could rise above $40B to $50B+ annually as it expands 3nm capacity and develops 2nm. Despite the spend, cash generation has historically stayed strong, supported by scale and premium product mix, and the company has produced high returns on equity around 30% to 40% in recent years. TSMC also uses long term agreements and prepayments for scarce advanced capacity, improving demand visibility and reducing the risk of idle fabs. The flywheel is clear: invest to stay ahead, earn premium margins, then reinvest to widen the lead.