- GritALPHA

- Posts

- A Full Analysis of Fluence Energy ($FLNC)

A Full Analysis of Fluence Energy ($FLNC)

An AI-enabler that's up +103% over the past year.

Together with Quantify Funds

Hi everyone,

Today we’ll be breaking down a company with products that are designed for the most demanding industrial applications. This under-the-radar AI play is up +103% over the past year, and is certainly worth a closer look.

Let’s dive into Fluence Energy (FLNC).

Stock Pick: Fluence Energy (FLNC-US, $4.9B MCAP)

Fluence Energy (FLNC) is quietly becoming one of the most important enablers of the AI era.

As data centers scale and grids strain under spiky, always-on demand, battery storage is shifting from optional to essential infrastructure.

That is Fluence’s sweet spot: turnkey grid-scale systems paired with software that can turn batteries into smarter, revenue-optimizing assets.

With a $5B+ backlog, expanding recurring revenue, and improving margins, the company is moving from hype to execution. The question now is simple: can Fluence convert today’s tailwinds into durable profitability and a bigger rerate?

Why now? 👉Riding the AI Infrastructure Wave

Overview 👉 What Fluence does and its role in the ecosystem

How battery storage fits into the AI power puzzle

Policy tailwinds 👉 Government boost for storage

How do they win? 👉 Value proposition

Business units 👉 Segment breakdown

How do they make money? 👉 Revenue model

By the numbers 👉 Key metrics

Competition and outlook

Risks 👉 Potential pitfalls

Wrapping up

Why now? 👉 Riding the AI Infrastructure Wave

Fluence Energy (FLNC) is trading near multi-year highs around $25 per share, lifted by investor excitement that grid-scale batteries are becoming essential infrastructure for both AI data centers and the clean-energy transition. With a market cap around $4.5B, shares have more than doubled over the past year, outpacing many energy tech peers as the market looks for “picks-and-shovels” winners tied to surging compute demand.

Operationally, the story has improved: Fluence delivered its first profitable quarter in late 2025 and expanded margins even while supply chain issues pushed some revenue into later periods. Sentiment is split in a constructive way, with bulls pointing to leadership in battery storage, a record $5B+ backlog, and strengthening unit economics, while skeptics focus on the speed of the run-up and execution risk. With policy incentives supporting storage and AI-driven power needs accelerating, the next few quarters look like an inflection window where strong delivery could translate the narrative into durable earnings power.

Source: Company Filings

Overview 👉 What Fluence does and its role in the ecosystem

Fluence Energy provides grid-scale battery energy storage systems (BESS) and energy management software that help store electricity and deliver it when needed. That “time-shifting” capability becomes critical as solar and wind penetration rises, because it smooths intermittency and supports grid reliability during peaks. Founded in 2018 as a joint venture between AES and Siemens, Fluence has scaled quickly, deploying or contracting tens of gigawatt-hours across the U.S., Europe, Asia, and other markets.

Its offerings span large battery farms for utilities and grid operators, plus behind-the-meter systems for industrial sites and increasingly for data centers. Alongside hardware, Fluence sells digital tools, including the Fluence IQ platform, that optimize battery dispatch, performance, and market participation so customers can improve reliability and potentially monetize price spikes through intelligent charging and discharging. In the AI data center buildout, Fluence batteries can sit on-site or near substations to buffer load swings, reduce downtime risk, and cut reliance on diesel backups. The model mixes project sales with long-term services and subscription software.

Together with Quantify Funds

Designed to Generate Options Income Off the Performance of 2x Stacked Bitcoin & Gold

Designed to Generate Options Income Off the Performance of 2x Stacked US Stocks & Bitcoin

Total Return & Weekly Options Income

Tax Efficient Options Strategies

Return Stacking - Addition without Subtraction

How battery storage fits into the AI power puzzle

Modern grids must balance supply and demand in real time, but renewables and large digital loads add volatility. Battery storage solves the flexibility gap by decoupling generation from consumption, capturing excess power when it is abundant and releasing it when demand surges or generation drops. That is vital for renewables, but it is also increasingly vital for AI-heavy data centers that draw massive electricity and can create sudden load spikes that strain local infrastructure. Batteries respond in milliseconds, supporting frequency and voltage, reducing the need for peaker plants, and providing a clean, fast bridge during disturbances.

For data centers specifically, storage can act as a power shock absorber: it can cover rapid ramp events, support seamless ride-through during grid faults, and provide backup that is faster and cleaner than diesel generators. At scale, widespread storage strengthens resiliency and helps accommodate new electrified demand, from EV charging to mega data centers, without constant emergency upgrades. Fluence sits at this intersection by delivering storage systems and control software designed to keep power stable, costs manageable, and uptime high.

Policy tailwinds 👉 Government boost for storage

Policy support has become a major accelerant for energy storage deployment, particularly in the U.S. The Inflation Reduction Act established a 30% investment tax credit for stand-alone storage and introduced bonus credits tied to domestic content, improving project economics and increasing long-term visibility for developers and integrators. Fluence is positioning its supply chain to help customers qualify for incentives, including more domestic sourcing and assembly, which can improve competitiveness and reduce geopolitical exposure. Policy has also begun addressing the data center power crunch more directly, with actions aimed at streamlining permitting and pushing grid modernization so large loads can be served more quickly.

Regulators and agencies have also focused on faster, clearer interconnection processes for storage and renewables, reducing delays that can stall project timelines. Beyond the U.S., multiple regions are rolling out storage incentives and clean energy targets that expand the global addressable market. Net effect: storage is increasingly treated like core infrastructure, and incentives improve returns for buyers, which can translate into more volume for vendors like Fluence. While policy is never risk-free, today’s direction generally lowers friction, improves economics, and supports multi-year growth planning.

How do they win? 👉 Value proposition

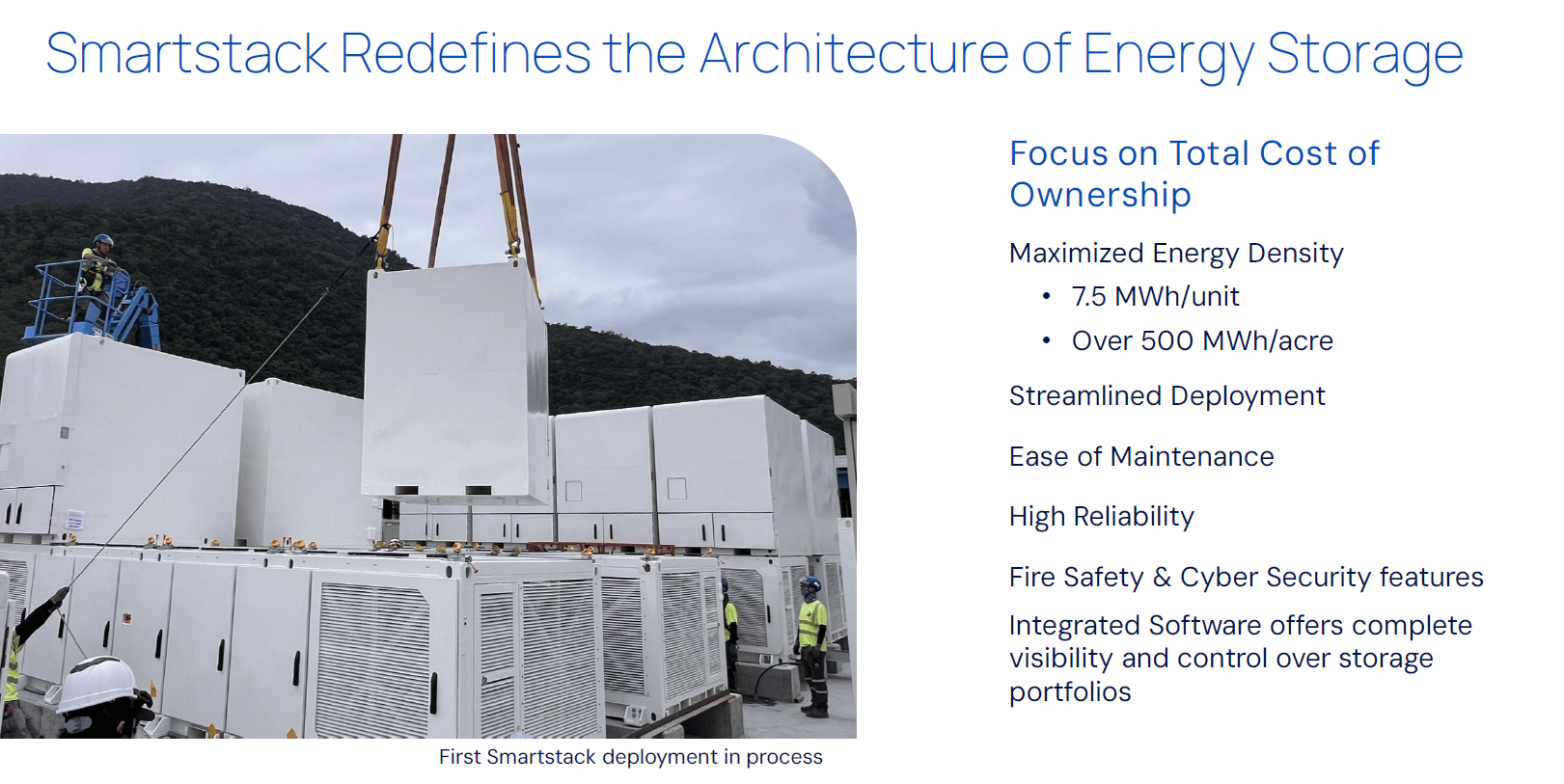

Fluence competes by offering an integrated, bankable storage solution rather than simply assembling commodity batteries. On the hardware side, its SmartStack system emphasizes modularity, factory-tested integration, and higher energy density, with claims of roughly 20% to 25% improvement versus typical alternatives, which matters for space-constrained sites like urban substations and data centers. Integrated power electronics, thermal management, and standardized design can shorten deployment timelines and improve safety and reliability, reducing total installed cost and execution complexity for customers.

Source: Company Filings

On the software side, Fluence IQ, including tools such as Mosaic and Nispera, aims to turn storage into a smarter asset by optimizing dispatch, maintenance, and market participation. That adds customer value while building higher-margin, recurring revenue and raising switching costs through operational integration. Fluence also benefits from heritage and partnerships tied to AES and Siemens, which help credibility, global reach, and execution capability across large, complex installations. Scale, experience, and data from deployed systems can feed continuous improvement, cost-down efforts, and performance differentiation. The strategy is to win with trust, turnkey delivery, and an expanding software and services layer.

Business units 👉 Segment breakdown

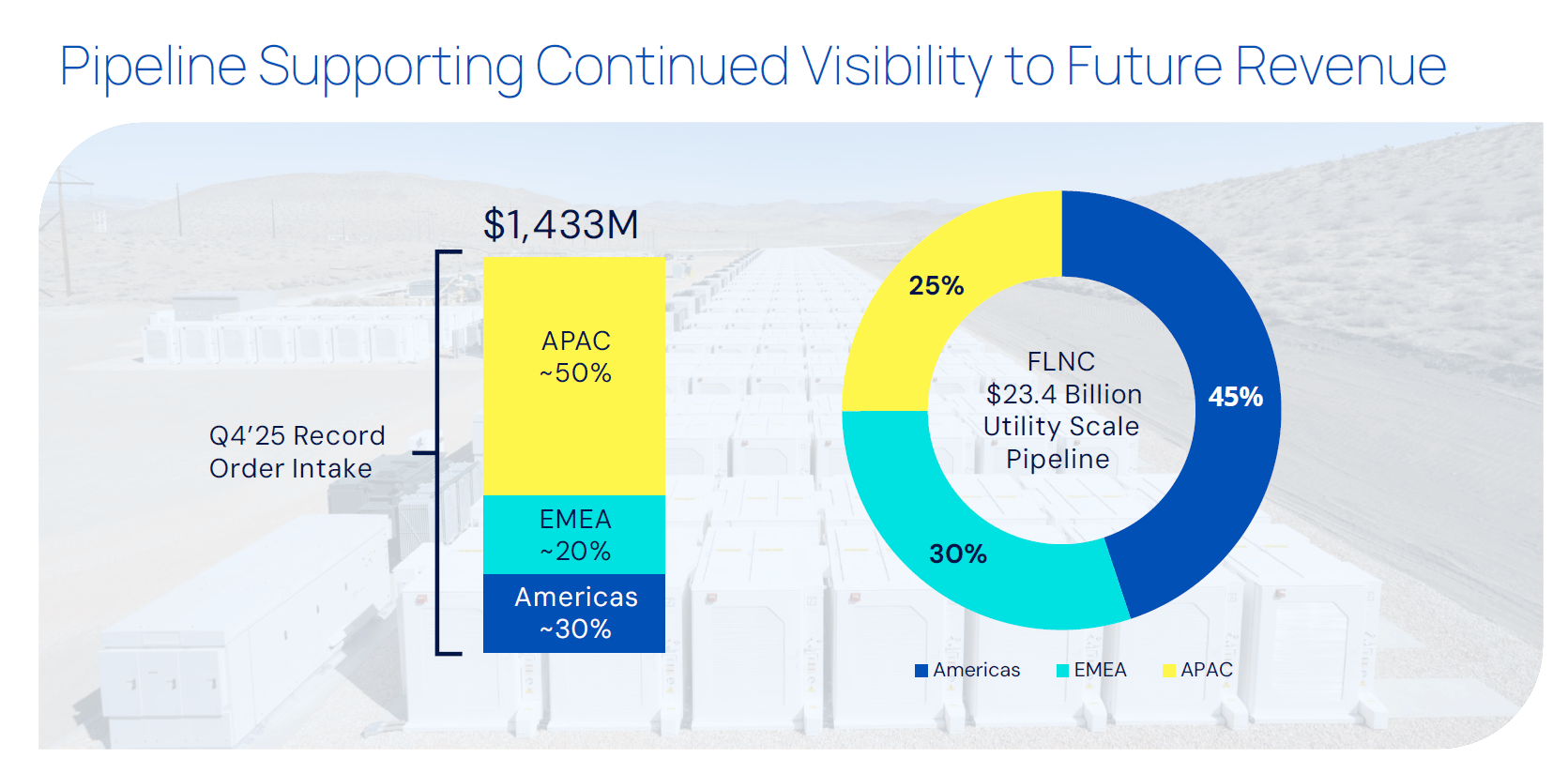

Fluence reports two primary segments: Energy Storage Products & Solutions, and Services & Digital. Products & Solutions is the core business, roughly 90% to 95% of revenue, covering the design, engineering, procurement, construction, and commissioning of turnkey BESS projects for utilities, developers, and large commercial customers. These are big, milestone-based contracts that can create quarterly lumpiness, but backlog provides visibility. As of late 2025, contracted backlog was about $5.3B, supporting multi-year delivery and revenue conversion.

Services & Digital is smaller today but strategically critical: it includes multiyear service agreements, monitoring, maintenance, software updates, and subscriptions to Fluence’s optimization platforms. These recurring streams are typically higher margin and more predictable than project revenue, helping smooth results and lift overall profitability as they scale. Fluence’s annual recurring revenue reached about $148M in FY2025, up roughly 50% year over year, and management expects continued growth as more projects bundle software and long-term services. Over time, a richer mix of Services & Digital is intended to improve margin structure, reduce cyclicality, and strengthen customer retention.

How do they make money? 👉 Revenue model

Fluence generates most revenue from upfront sales of turnkey storage projects, recognizing revenue as systems are delivered or hit contractual milestones. Project sizes vary widely, from smaller commercial installations to utility-scale deployments that can reach hundreds of millions of dollars per site. This makes results sensitive to project timing, since typical execution can span 6 to 18 months and revenue can cluster when major jobs complete. In FY2025, revenue was roughly $2.6B, primarily from completed project deliveries.

Source: Company Filings