- GritALPHA

- Posts

- A Full Analysis of Expedia ($EXPE)

A Full Analysis of Expedia ($EXPE)

You can fight AI, or you can integrate with it...

Hi everyone,

Today we’ll be breaking down a company that most of you have probably used — but you likely didn’t know its stock was up +66% over the past year…

Let’s dive into Expedia (EXPE).

Stock Pick: Expedia (EXPE-US, $36B MCAP)

Expedia is quietly making a bet most consumer internet companies refuse to make.

The next wave of disruption is not a new competitor, it is a new interface. AI agents will increasingly plan trips the way humans used to: ask, compare, decide, book. The risk for travel sites is obvious. If the booking happens inside ChatGPT, Gemini, or a voice assistant, the old game of winning clicks starts to matter less.

Expedia’s response is not to wall off the ecosystem. It is to become the easiest travel platform for AI to plug into. That is a subtle but important distinction. If the world shifts from “where do I search?” to “who can my agent book with?”, Expedia wants to be the default pipe that still captures the transaction.

Layer on a surging B2B engine and expanding margins, and you get a company that looks less like a legacy OTA and more like travel infrastructure for an agentic internet.

Why Now? 👉 Integrating with AI Interfaces

Overview 👉 What Does Expedia Do?

Role in Ecosystem 👉 How Expedia Fits into Online Travel

How Do They Win? 👉 Value Proposition

Business Units 👉 Segment Breakdown

How Do They Make Money? 👉 Revenue Model

By the Numbers 👉 Key Metrics

Moving Forward 👉 Competition and Outlook

Risks 👉 Potential Pitfalls

Bonus Section 👉 Expedia’s B2B Boom, the Hidden Engine

Why Now? 👉 Integrating with AI Interfaces

Expedia is at an inflection point as AI changes how consumers discover and book travel. If chat-based assistants and “agentic” workflows become a primary interface, the winners will be the platforms that are easiest to plug into, not just the sites with the best front-end UX. Expedia is leaning into that shift rather than fighting it. Management has been explicit that the goal is to make Expedia’s inventory, pricing, and booking rails available wherever trip planning happens, including third-party AI agents.

That posture is strategically important because it reframes AI as a distribution expansion, not purely a traffic threat. Expedia has already demonstrated early execution with conversational trip planning integrations and new discovery features that translate inspiration into itineraries and bookings. Internally, the company is also deploying AI agents to automate workflows and improve service outcomes, reinforcing a dual mandate: defend demand capture in a changing interface landscape while using AI to structurally lower costs. The urgency is straightforward: interface shifts can reallocate industry economics quickly, and Expedia is positioning to remain a necessary node.

Source: Company Filings

Overview 👉 What Does Expedia Do?

Expedia Group is a global online travel platform that helps consumers plan and book lodging, flights, rental cars, packages, and activities. Its brand portfolio spans broad OTAs (Expedia.com), lodging-focused brands (Hotels.com), and alternative accommodations via Vrbo, plus additional regional and legacy brands. At its core, Expedia runs a two-sided marketplace: travelers get breadth of supply and convenient booking, while travel suppliers gain distribution, demand generation, and tools to manage and monetize inventory.

Scale is central to the model. Expedia has built deep supplier relationships and accumulated decades of travel and intent data, which improves merchandising, personalization, and conversion. Importantly, Expedia operates both B2C and B2B. The B2C side is the consumer-facing storefront. The B2B side provides inventory, technology, and booking infrastructure to partners such as loyalty programs, travel agencies, and other travel sellers. This combination matters because it diversifies demand sources and creates multiple ways to monetize the same supply base, which becomes more valuable as booking flows fragment across apps, partners, and AI interfaces.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Role in Ecosystem 👉 How Expedia Fits into Online Travel

Expedia functions as a distribution hub between fragmented travel supply and global travel demand. For consumers, it aggregates options across hotels, rentals, flights, cars, and activities, reducing search friction in a complex category. For suppliers, it provides incremental bookings and marketing reach, particularly for independents or for large brands trying to fill marginal capacity across geographies and seasons. Expedia monetizes that role through commissions, merchant margins, and advertising, while also embedding itself deeper via partner tools and APIs.

Competitive dynamics are constant. Expedia competes with Booking for OTA share and with Airbnb in alternative accommodations through Vrbo. It also competes indirectly with suppliers’ direct channels, which use loyalty and pricing strategies to reduce OTA dependence. Another key ecosystem tension is discovery. Google remains both a vital traffic source and a long-term threat given its control of search and travel metasearch surfaces. Now add AI agents: if trip planning shifts from search results pages to conversational assistants, Expedia’s objective is to be the backend provider that still captures the transaction, even if the consumer never “visits” an Expedia domain.

How Do They Win? 👉 Value Proposition

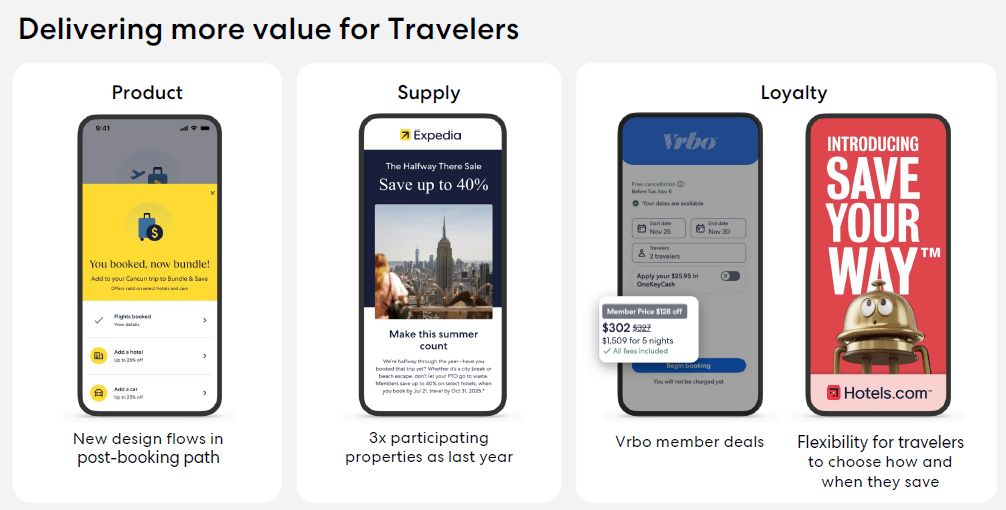

Expedia’s value proposition is scale plus convenience for travelers and demand plus tooling for partners. On the consumer side, the pitch is one-stop shopping: travelers can bundle flights, lodging, and activities, often with package pricing that improves perceived value while increasing Expedia’s ability to monetize the lodging component. Rich content, reviews, maps, and personalization aim to reduce decision fatigue and improve conversion, and newer AI features are designed to compress planning time and surface better-fit options.

Source: Company Filings

Loyalty is the strategic glue. The One Key program unifies rewards across Expedia, Hotels.com, and Vrbo, encouraging repeat usage and cross-brand engagement while supporting more direct demand (which is structurally more profitable than paid acquisition).

On the partner side, Expedia provides distribution and a tech stack. The company’s data depth and marketplace breadth support targeting, pricing insights, and ad products for suppliers. AI also underpins operating leverage: automation in customer service and internal workflows can reduce variable servicing costs while maintaining quality, improving margin durability as volume scales.

Business Units 👉 Segment Breakdown

Expedia’s operations are best understood as three monetization engines. First is Retail (B2C), which includes Expedia.com, Hotels.com, Vrbo, and other consumer brands. Lodging is the primary profit pool, with flights often serving as a basket-builder that supports cross-sell into higher-margin hotels and packages.

Source: Company Filings

Second is B2B Travel Partnerships, often associated with Expedia Partner Solutions and travel agent programs. Here Expedia provides white-label and API-driven access to its inventory and booking capabilities for partners such as loyalty portals, travel agencies, and other travel distributors. This segment benefits from scale, stickier integrations, and typically lower customer acquisition costs because the partner brings demand.