- GritALPHA

- Posts

- A Full Analysis of Coinbase ($COIN)

A Full Analysis of Coinbase ($COIN)

Paying the toll collector....

Together with X Funds

Welcome back to GRIT Alpha! This week, we’re breaking down a company that’s worth nearly $100B and is spoken about daily… but is only up +12% since it’s IPO. Let’s talk Coinbase.

It’s up +50% YTD… is there more upside ahead? It’s actually one of the largest holdings of the ETF mentioned below too!

Let’s dive in.

Looking to gain exposure to crypto without the wild swings? The Nicholas Crypto Income ETF (BLOX) offers a unique solution: exposure to the crypto ecosystem and the opportunity for weekly income.

BLOX is designed to provide:

Access to Bitcoin & Ether through ETFs and ETPs

Equity exposure to crypto industry leaders — from miners to DeFi platforms

Weekly income through options strategies on portfolio holdings

Whether you’re crypto-curious or looking to add yield potential to your portfolio, BLOX gives you broad exposure in a single ticker.

👉 Learn more at NicholasX.com/BLOX

Stock Pick: Coinbase (COIN-US, $97B MCAP)

We need to talk about this… AGAIN.

For those that closely followed my previous Circle pick… congratulations, the stock is up on a stick since.

For those that didn’t… it’s not too late.

Stablecoins are having a very critical moment here in traditional finance. We have recognized that existing systems are antiquated and transaction fees amongst the dominant players have collected rent for far too long.

We need to modernize the financial system, and with legislation finally starting to move in the right direction, I think we’re only getting started.

When you think about this name, you don’t have to bet on hitting blackjack.

This pick is betting on the house.

Why Now? 👉 Stablecoin Legislation Tailwinds with the GENIUS Act

Overview 👉 What Does Coinbase Do?

Where Do They Fit? 👉 Coinbase's role within crypto

How Do They Win? 👉 Value Proposition

How Do They Make Money? 👉 Transaction, Subscription

Tokenization & Real-World Assets 👉 Coinbase’s Next Frontier

The Numbers 👉 Key Metrics

Risks 👉 Potential Pitfalls

Why now? 👉 Stablecoin Legislation Tailwinds with the GENIUS Act

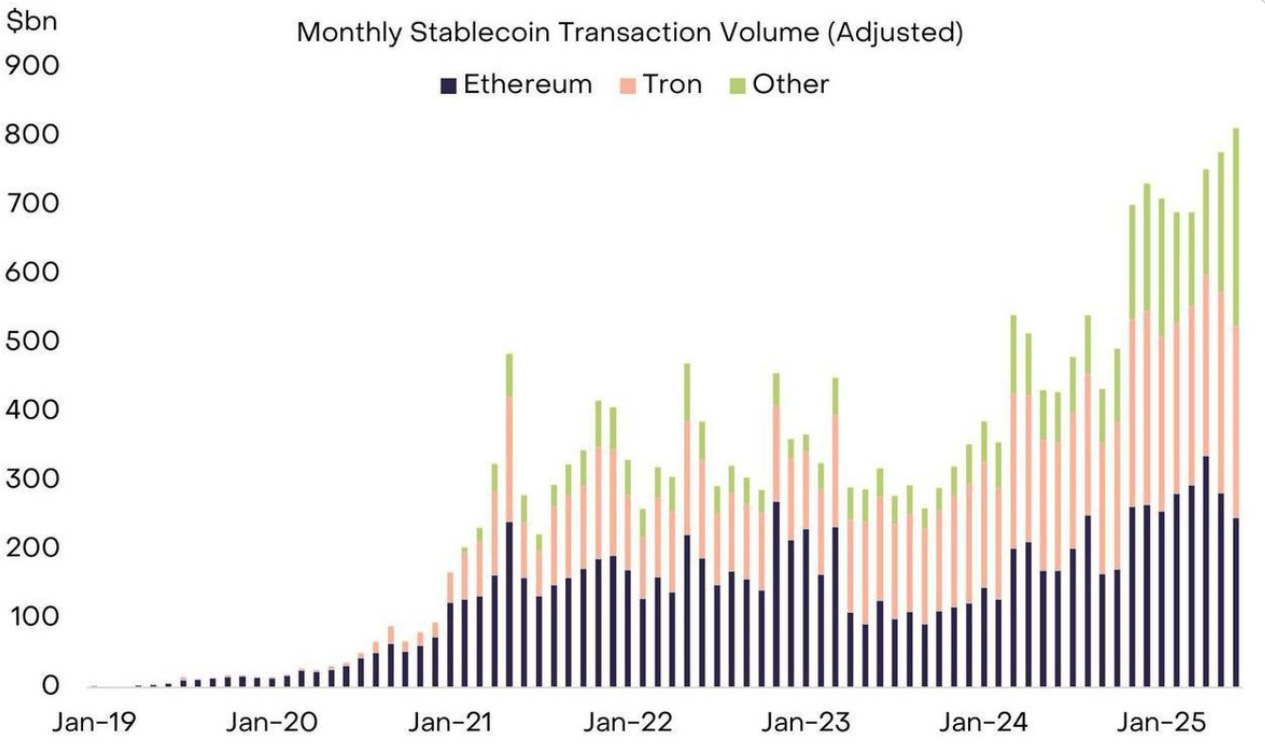

Cryptocurrency’s legitimacy is accelerating, and Coinbase stands to gain. June 2025’s bipartisan GENIUS Act, the first U.S. framework for stablecoins, mandates 1:1 reserves, monthly audits, and federal oversight, with final passage expected by summer. That clarity has pushed stable‑coin value to a record $251.7 billion (+22 % YTD).

Source: Visa, Allium, Grayscale Investments

Coinbase owns 40% of Circle, issuer of USD Coin (USDC), now a $60 billion “compliant digital dollar.” Regulatory approval broadens USDC’s institutional appeal and lets Coinbase share in a market that could exceed $260 billion. The stablecoin market is set to continue rapid growth.

Two other tailwinds amplify the story: a judge tossed the SEC’s lawsuit against Coinbase in early 2025, and in May the exchange became the first crypto‑native member of the S&P 500. Together, Washington’s embrace of stablecoins and Coinbase’s bet on USDC create a compelling “why‑now” narrative.

Overview 👉 What Does Coinbase Do?

Coinbase, founded in 2012, is one of the world’s largest crypto exchanges and seeks to “increase economic freedom” by bridging fiat and digital assets. More than 100 million verified users across 100+ countries can securely buy, sell, and store Bitcoin, Ethereum, and 200+ other coins through its web and mobile apps. The platform’s simple interface makes it a go‑to on‑ramp: users link bank accounts or cards to swap local currency for crypto (and back).

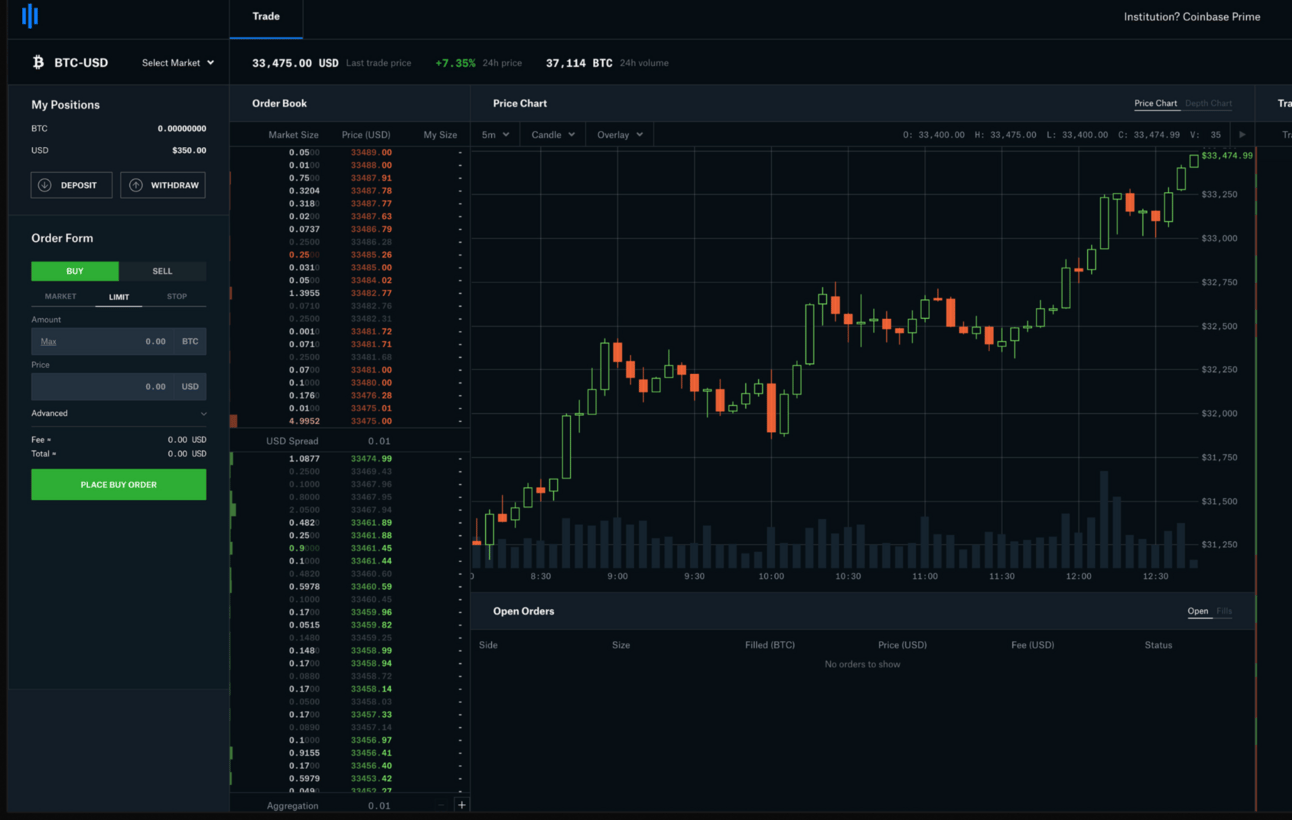

Now a publicly traded, U.S.‑regulated company, Coinbase has broadened far beyond basic trading. Its ecosystem includes advanced trading tools (formerly Coinbase Pro), staking for yield on assets like ETH, an NFT marketplace, a self‑custody wallet, institutional custody and brokerage, Coinbase Commerce for merchant payments, and a Visa debit card that lets users spend crypto. Rigorous KYC/AML procedures and transparent financial reporting underpin a trusted reputation in a sector often marred by scandal. In short, Coinbase offers both retail and institutional clients a regulated, full‑suite gateway to the crypto economy.

Where Do They Fit? 👉 Coinbase's Role within Crypto

In the crypto ecosystem, Coinbase plays a pivotal role as “the adult in the room”, a regulated, transparent exchange in a sector where many competitors operate offshore or in legal gray areas. After the collapse of unregulated platforms like FTX in 2022, Coinbase’s status as a U.S.-based, publicly audited company became a major differentiator. As regulators cracked down on crypto exchanges, Coinbase emerged as one of the best-positioned to endure, thanks to its compliance-first model.

Even amid heightened scrutiny from the SEC and other agencies in 2023–24, Coinbase grew its market share as less compliant platforms stumbled. By early 2025, it became the first crypto firm added to the S&P 500, a milestone reinforcing its role as a pillar of the industry, not a speculative outlier.

That said, Coinbase isn’t the largest exchange by trading volume. Binance, with ~38% of global spot volume as of April 2025, far outpaces Coinbase’s 6–7%. In a 24-hour snapshot in May, Coinbase processed $3.3 billion in spot volume versus Binance’s $20 billion. The disparity reflects Coinbase’s focus on regulated markets (mainly North America and Europe) and its refusal to list high-risk tokens or offer high leverage, common among offshore rivals.

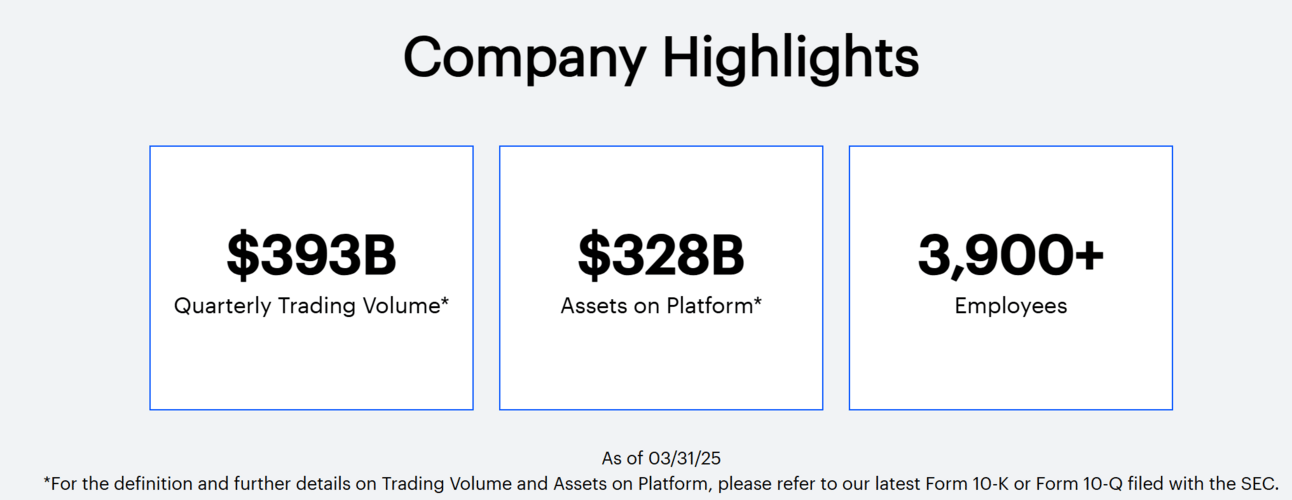

Still, in the U.S., Coinbase dominates the retail market, serving as the primary on-ramp for American crypto investors. It reported over 100 million accounts and 9.7 million monthly transacting users in Q1 2025, well ahead of competitors. It also serves institutions like hedge funds and asset managers through Coinbase Prime and held $328 billion in custody assets that quarter, including crypto backing BlackRock’s ETF.

Source: Company Website

More than just a trading platform, Coinbase is becoming core crypto infrastructure. It operates “Base,” its own Layer-2 blockchain, and offers APIs and blockchain services via Coinbase Cloud. Like Amazon Web Services underpins the internet, Coinbase is positioning itself as a Web3 backbone.

As a result, it’s increasingly viewed as a barometer for the crypto industry’s health, benefiting during bull runs and refocusing during downturns. Its unwavering commitment to compliance and security sets it apart, earning trust in a sector still marked by opacity. That trust makes Coinbase the closest thing to a “blue chip” among crypto exchanges.

How Do They Win? 👉 Value Proposition

Coinbase’s core value lies in trust, ease of use, and a growing suite of crypto services that reinforce user loyalty. In a sector plagued by hacks and opacity, Coinbase’s reputation for security and regulatory compliance stands out. It has never suffered a major hack, uses cold storage, and maintains audited reserves—factors that helped USDC remain a “safe” stablecoin during the 2023 volatility. Institutional players, from Tesla to BlackRock, prefer Coinbase’s SOC 2-certified custody, further cementing its role as a reliable partner in crypto.

For retail users, Coinbase pairs a simple interface with strong brand recognition. One-click trading, a top-rated app, and educational content lower the entry barrier, while high-profile marketing (like its 2022 Super Bowl ad) made it a household name for “buying Bitcoin.” As crypto expands into NFTs or the metaverse, Coinbase is poised to capture users already familiar with the brand.

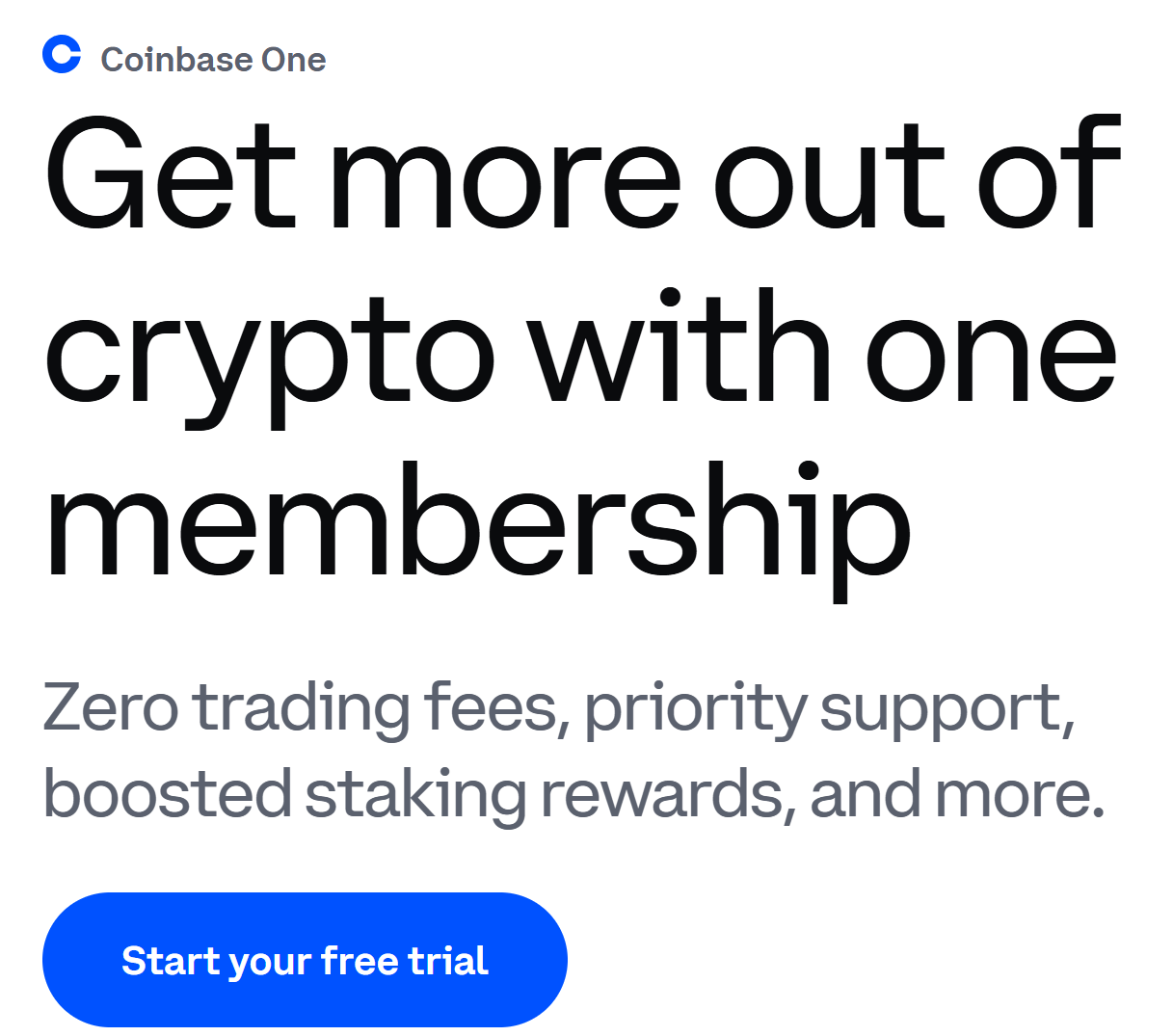

Recognizing the volatility of trading fees, Coinbase is diversifying. Its premium product, Coinbase One, launched in late 2022, offers benefits like zero fees and higher staking rewards. By Q1 2025, subscription revenue had grown 40% YoY, driving recurring income and customer retention. Coinbase has also pushed into payments, offering Visa and Amex crypto cards and Coinbase Commerce for merchant crypto settlements, often converted to stablecoins like USDC.

The firm’s ecosystem strategy deepens with bold bets. Its 2025 acquisition of Deribit for ~$2.9B thrust it into crypto derivatives, a high-margin space once dominated by offshore players. Its Layer-2 network, Base, launched in 2023, is drawing developers and on-chain activity, boosting wallet and USDC use across the platform.

Coinbase now spans trading, custody, stablecoins, payments, and infrastructure, making it more than just an exchange. By integrating across these verticals, it has built a resilient, diversified business that positions it as the “blue chip” of crypto, trusted, expansive, and ready for the next wave of adoption.

Source: S-1 Filing

How Do They Make Money? 👉 Transaction, Subscription

Coinbase has evolved from a trading-fee-driven model into a more diversified business with revenue from subscriptions, services, and interest income.

Transaction Fees remain the primary revenue driver, totaling $1.26 billion in Q1 2025, about two-thirds of total revenue. While institutions make up 80% of trading volume, most of the fee revenue ($1.1B) comes from retail users who pay higher fees for convenience and trust. This revenue stream is highly sensitive to crypto market activity, surging during bull runs and dipping during downturns.

Subscriptions and Services brought in $698 million in Q1 2025. This includes custodial fees, staking commissions, token campaigns, and especially interest income which is driven by Coinbase’s partnership with Circle. Stablecoin revenue alone hit $298 million, thanks to rising USDC balances and yields of 3–4%. Staking added $197 million, though this remains sensitive to crypto prices and regulation.

Coinbase One, launched broadly in 2023, offers users zero commissions, priority support, and waived gas fees. While still a small part of revenue, adoption is growing. Services revenue rose 36% year-over-year by Q1 2025.

Source: Company Website

Other Revenues (e.g., crypto conversions, interest on fiat, venture gains) added ~$74 million in Q1. While minor, they reflect Coinbase’s growing ecosystem and optionality.

Despite lower retail trading volumes in early 2025, growing subscription and interest income helped offset the decline. Coinbase ended Q1 with $9.9 billion in cash and USDC, no long-term debt, and a strengthened balance sheet.

In short: Coinbase earns from trading, holding, and engaging with crypto. Its growing non-trading revenue streams offer resilience and upside as the industry matures.

Tokenization & Real-World Assets 👉 Coinbase’s Next Frontier

Coinbase is actively positioning itself to lead the next fintech wave: tokenization—bringing traditional assets like stocks and bonds onto the blockchain. In June 2025, it sought SEC approval to offer tokenized equities, allowing users to trade assets like Apple or Tesla shares as crypto tokens. This could enable 24/7 trading, instant settlement, fractional ownership, and reduced costs, essentially merging stock markets with crypto infrastructure. If approved, Coinbase would compete directly with brokers like Robinhood and Schwab.

This initiative is a major strategic focus. However, tokenized stock trading isn’t currently legal in the U.S., and Coinbase is seeking regulatory relief via a no-action letter. The SEC remains cautious, citing investor protection and ownership clarity. Still, the global momentum is building: Kraken launched tokenized U.S. stocks abroad, and firms like BlackRock are tokenizing money market funds.

By early 2025, over $50 billion in real-world assets (RWAs) had been tokenized, ranging from bonds to real estate, and forecasts suggest that could hit $500 billion by year-end. The potential is massive: the $100+ trillion traditional asset market could gradually shift on-chain if technology and regulation align.

Coinbase is laying groundwork: it already holds a broker-dealer license, and developers on its Base network have issued tokenized assets like “bCOIN” (a tokenized version of Coinbase stock). These steps signal its ambition to become a universal financial platform, offering users the ability to hold Bitcoin, USDC, and tokenized equities in one app.

The upside is clear: if successful, tokenization could boost user engagement, stablecoin usage (via USDC), and transaction volume on Base. Challenges that remain are liquidity, regulation, and investor safeguards but the opportunity aligns with Coinbase’s mission to modernize finance. With early moves and deep infrastructure, Coinbase is aiming to be the front-runner in this next chapter of digital finance.

By The Numbers 👉 Key Metrics

Coinbase’s Q1 2025 numbers signal a strong rebound as the crypto market recovers. Net revenue hit $2.03 billion, up 24% YoY, generating a $66 million GAAP profit (EPS ~$0.24) and $1.94 in adjusted EPS. Adjusted EBITDA was $930 million (45% margin), supported by cost-cutting and high-margin interest income.

Revenue Mix: Trading revenue totaled $1.26 billion (+17% YoY), while subscriptions and services grew 36% to $698 million, now 34% of total revenue. Standouts included $298 million from stablecoin interest and $197 million from staking rewards, showing success in revenue diversification.

Trading Activity & Users: Coinbase handled $393 billion in Q1 volume—up sharply from $145 billion in Q1 2024. Institutions drove over 80% of volume. Monthly Transacting Users (MTUs) came in at 9.7 million, flat QoQ, down from the 2021 peak but stable post-2022. Total verified users exceed 110 million.

Assets on Platform reached $328 billion, up nearly 3x from late 2023 and above the previous 2021 peak. Bitcoin and Ether dominate holdings, alongside ~$12 billion in USDC.

USDC & Stablecoins: USDC’s market cap reached $60 billion, with Coinbase now holding 22% of supply (vs. 14% a year earlier). That drove $100M+ in Q1 revenue through its Circle partnership. With the stablecoin market near $250 billion, this segment is now a major profit contributor.

Financial Strength: Coinbase ended Q1 with $9.9 billion in cash/USDC and zero long-term debt. COIN stock has rallied ~148% in Q2 alone, surging from $143 to $353, and is up ~100% YoY, and now back above it’s IPO peak. The rally reflects rising investor optimism amid profitability and regulatory wins.

In summary, Coinbase is back to growth: revenues are climbing, high-margin income is expanding, and operating leverage is improving. The company is showing strong momentum, but sustainability will depend on future crypto market conditions and interest rates. For now, it stands tall as the leading player in a resurgent sector.

Risks 👉 Potential Pitfalls

Regulatory Uncertainty: Despite recent legal wins, Coinbase’s future remains heavily influenced by shifting regulations, especially regarding stablecoins and tokenized securities. A change in political leadership or SEC stance could derail key initiatives or increase compliance costs.

Crypto Market Volatility: Coinbase’s financials remain tied to crypto’s boom-bust cycles. Bear markets and falling prices can sharply reduce trading volumes, interest income, and user engagement. While high in bull markets, revenues and margins can quickly contract if sentiment or interest rates drop.

Intense Competition: Coinbase faces growing pressure from global rivals like Binance, smaller centralized exchanges, and decentralized platforms that bypass intermediaries. Fee compression, product innovation, or a strong comeback by a rebranded FTX could all threaten Coinbase’s market share and margins.

Security and Technical Risks: As a major custodian, Coinbase is a constant target for hackers; a recent third-party breach highlighted the financial and reputational risks of cyberattacks. Outages during high-traffic periods or future breaches could erode trust and push users toward competitors.

Execution Risks in New Ventures: Expanding into derivatives, tokenized stocks, and its Base network involves major execution and regulatory risks, especially given large upfront investments. If adoption stalls or regulations block progress, Coinbase may struggle to justify these initiatives’ costs.

Wrapping Up…

Coinbase has transformed from a basic Bitcoin brokerage into a leading player bridging crypto and traditional finance. With recent tailwinds like stablecoin legislation, growing institutional adoption, and a more favorable regulatory landscape, the company is positioned for long-term growth. Its strong brand, diversified product ecosystem, and improved financials make it a key beneficiary of the digital asset boom and the broader tokenization trend.

That said, Coinbase’s stock reflects high expectations and remains closely tied to crypto market cycles. Regulatory risks, execution challenges in new ventures, and intensifying competition could create headwinds. For believers in crypto’s future, Coinbase offers high upside, but with volatility.

It’s not just a trading platform anymore. It is becoming the infrastructure layer of crypto finance.

For those looking for the best Week in Review and Investing Week Ahead posts online — subscribe to the Grit Flagship newsletter below! 📩

Plus, join over 500k+ GRIT social media followers on Instagram, TikTok, X (Twitter), and LinkedIn! 📲 Get investing news in real time, and have fun with us as we explore the culture of investing and wealth building and share daily inspiration!

Cheers,

The GRIT Alpha Team

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. The author of this post manages a fund that has a position in COIN.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Grit publishes content through Beehiiv, an email newsletter platform and operates the websites Gritcap.io and social media accounts (including but not limited to): Instagram, Twitter, Linkedin, TikTok, YouTube, SnapChat, Facebook and Threads. By accessing Grit’s content, you agree to be bound by the Terms of Use and Privacy Policy, in effect at the time you access this website or any page thereof or any of Grit’s content. The Terms of Use and Privacy Policy may be amended from time to time. Nothing on this website or Grit constitute an offer to sell, or a solicitation of an offer to buy or subscribe for, any securities to any person in any jurisdiction where such an offer or solicitation is against the law or to anyone to whom it is unlawful to make such offer or solicitation. Grit is not an underwriter, broker-dealer, Title III crowdfunding portal or a valuation service and does not engage in any activities requiring any such registration. Grit does not provide advice on investments or structure transactions. Offerings made under Regulation A under the U.S. Securities Act of 1933, as amended (the "Securities Act") are available to U.S. investors ONLY who are “accredited investors” as defined by Rule 501 of Regulation D under the Securities Act well as non-accredited investors, who are subject to certain investment limitations as set forth in Regulation A under the Securities Act. In order to invest in Regulation A offerings, investors may be asked to fill out a certification and provide necessary documentation as proof of your income and/or net worth to verify that you are qualified to invest in offerings posted on this website. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. Grit does not verify the adequacy, accuracy or completeness of any information. Neither Grit nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, valuations of securities or completeness of any information on this site or the use of information on this site. Neither Grit nor any of its directors, officers, employees, representatives, affiliates or agents shall have any liability whatsoever arising from any error or incompleteness of fact, or lack of care in the preparation of, any of the materials posted on this website. Investing in securities, especially those issued by start-up companies, involves substantial risk. investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis.

Please read: Terms of Use, Privacy Policy, Disclosure Policy, State Disclosure Policy, and Disclaimer Policy

If you have any questions please contact us at [email protected]