- GritALPHA

- Posts

- A Full Analysis of Camtek ($CAMT)

A Full Analysis of Camtek ($CAMT)

The machines that build the machines...

Together with Quantify Funds

Hi everyone,

Today we’ll be breaking down a company that’s (very quietly) up +508% over the past five years. Yes — you read that correctly.

Let’s dive into Camtek (CAMT).

Stock Pick: Camtek (CAMT-US, $6.8B MCAP)

Camtek (CAMT) isn’t building the AI chips everyone’s talking about. It’s building the machines that decide whether those chips get to exist at all.

As AI accelerators, chiplets, hybrid bonding, and HBM stacks push packaging into the sub-micron danger zone, “good enough” manufacturing stops being a thing. One hidden crack, one misalignment, one void in a micro-bump, and a $10,000+ package can turn into scrap. That’s where Camtek shows up: its inspection and metrology tools act as the quality gate between a wafer that looks fine and a system that actually works.

This deep dive breaks down what Camtek does, why it wins in advanced packaging, what the numbers say, and the risks that could trip up a company priced for near-perfection.

Why now? 👉 Integrating with AI Interfaces

Overview 👉 What Does Camtek Do? Role in Ecosystem

How Do They Win? 👉 Value Proposition

Business Units 👉 Segment Breakdown

How Do They Make Money? 👉 Revenue Model

By The Numbers 👉 Key Metrics

Competition and Outlook 👉 Facing Giants, Eyeing Growth

Risks 👉 Potential Pitfalls

Wrapping Up…

Why now? 👉 Integrating with AI Interfaces

Camtek Ltd (CAMT) is benefiting from the AI hardware boom as more semiconductor spend shifts into advanced packaging and yield improvement. Investors frame Camtek as a picks-and-shovels play because its inspection and metrology tools help chipmakers and packaging houses reliably produce leading-edge AI processors and advanced memory.

Source: Company Filings

Recent quarters have supported the excitement with strong growth, margin expansion, and record revenue tied to hyperscaler and chipmaker demand. tably, Camtek’s tools are crucial for manufacturing high-end AI processors which is a factor that makes it strategically resilient even amid broader tech volatility. All told, Camtek finds itself at a pivotal moment: it’s riding a wave of AI-fueled growth and investor optimism, yet faces the challenge of executing flawlessly to justify its newly elevated status.

Overview 👉 What Does Camtek Do? Role in Ecosystem

Camtek makes automated optical inspection and metrology systems used in semiconductor manufacturing. Its tools act like the “eyes” of production, scanning wafers and advanced packages for microscopic defects and measuring critical dimensions so only known-good die proceed. While the company started in printed circuit board inspection, its focus today is the mid-to-back-end of chip production, especially advanced packaging. That includes wafer-level packaging, dense substrates, 3D stacks, and chiplet-based designs that power modern AI accelerators and high-bandwidth memory.

Source: Company Filings

Camtek’s role is a quality gatekeeper between front-end wafer fabrication and final assembly: it verifies chips and packages are free of cracks, voids, misalignments, and other issues before downstream steps make defects far more expensive. This matters more as interconnects shrink and architectures get more complex, where the margin for error is tiny. The company cites an installed base of 3,000+ systems across 300+ customers globally, with significant deployment at OSATs and leading Asian manufacturing hubs.

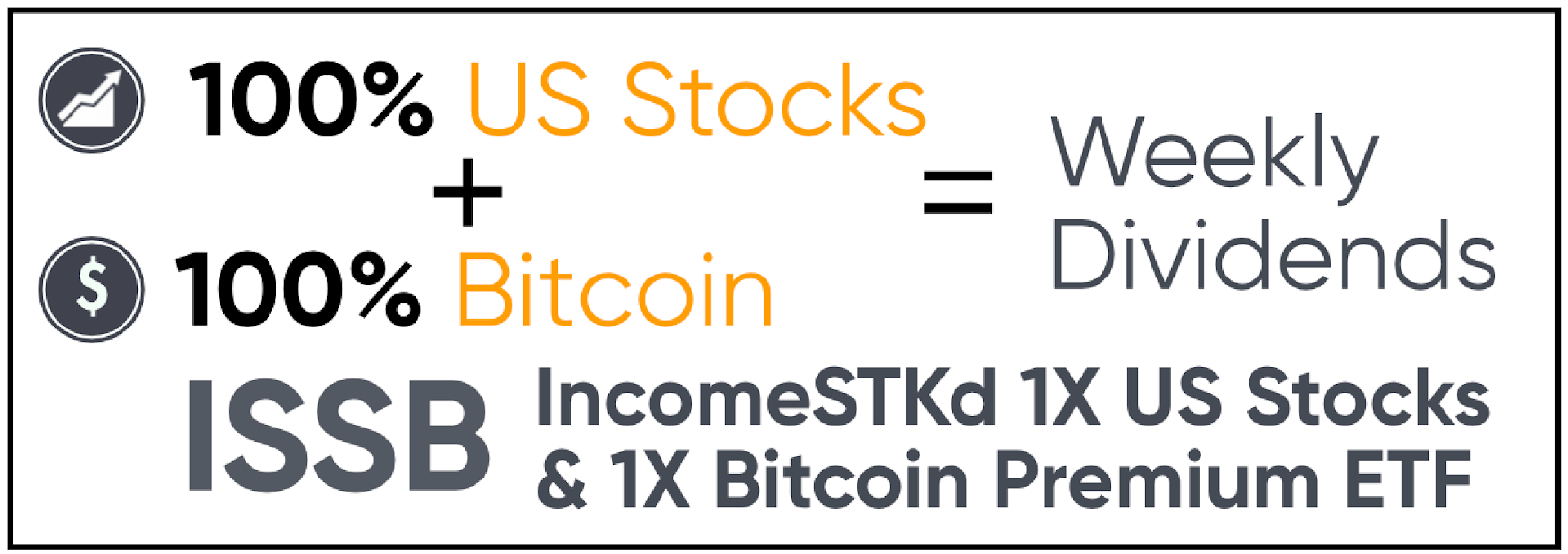

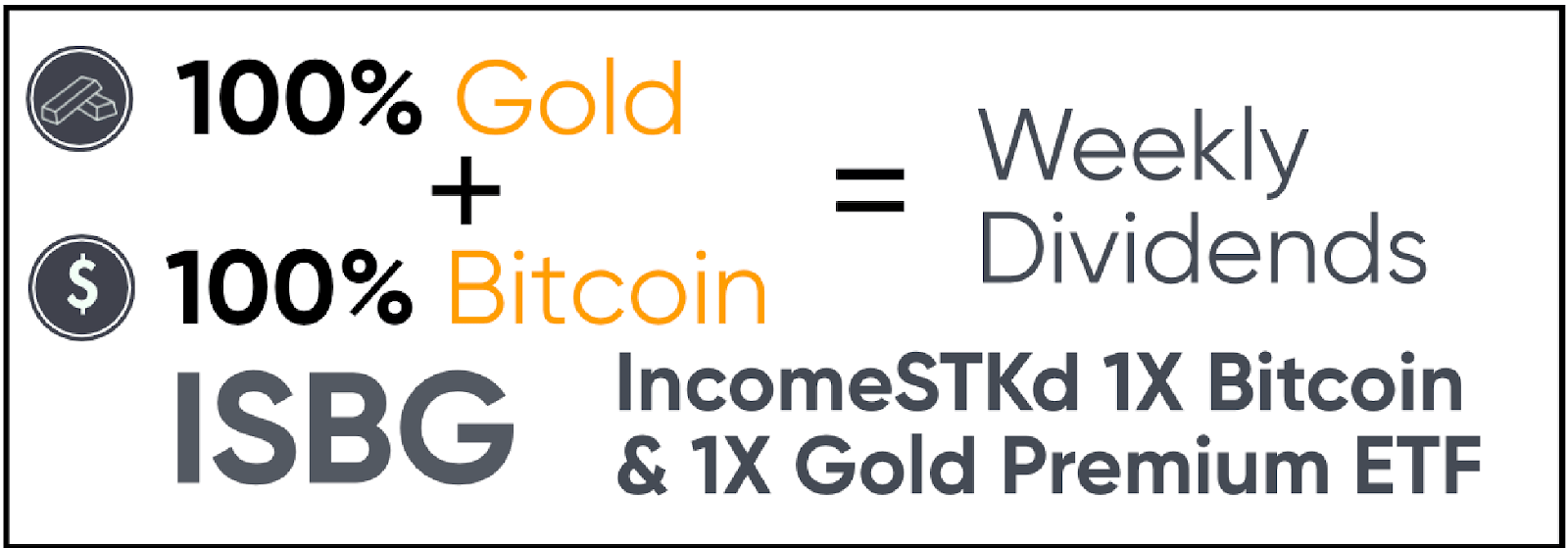

Together with Quantify Funds

Total Return & Weekly Options Income

Tax Efficient Options Strategies

Return Stacking - Addition Without Subtraction

How Do They Win? 👉 Value Proposition

Camtek wins by being a specialist in inspection and measurement challenges that intensify as packaging gets denser. Its product families address distinct needs across the flow: Eagle platforms for high-speed 2D/3D inspection in advanced packaging, Falcon for wafer bump metrology, and Gryphon for macro wafer inspection. The value proposition is precision, repeatability, and throughput, including sub-micron defect detection that becomes critical as interconnect pitches move below 10 microns. Camtek also leans into advanced packaging transitions, investing heavily in R&D to stay ahead of customer roadmaps like heterogeneous integration and hybrid bonding. A key example is the Eagle G5, designed for finer pitch requirements with improved optical resolution and speed for AI and HPC workloads.

On top of hardware, Camtek is increasingly adding software capabilities such as automated defect classification to reduce false rejects and improve yield learning. Finally, strong service, training, and responsiveness help drive repeat business as customers upgrade to next-generation tools, reinforcing a defensible niche moat.

Source: Company Filings

Business Units 👉 Segment Breakdown

Camtek is operationally focused, but its revenue mix spans multiple semiconductor applications. High-performance computing and AI-related demand drives close to half of sales, reflecting inspection needs for advanced GPU and accelerator packages and the manufacturing steps around them. Within that, memory-focused inspection has become a major pillar, with advanced memory workloads (much of it HBM-related) around 30% of revenue.

The remainder comes from other segments that still require tight packaging control, including CMOS image sensors, power and RF devices, MEMS, and other chips adopting fan-out and related packaging methods. Camtek’s acquisition of FormFactor FRT added complementary 3D surface measurement metrology, broadening the portfolio beyond optical defect finding and enabling more bundled “inspection plus measurement” deals. The customer base skews heavily toward OSATs, alongside foundries and IDMs that run advanced packaging lines. Geographically, revenue is highly Asia-centric, about 90% of sales, mirroring where most packaging and test capacity sits, with the balance split between North America and Europe.