- GritALPHA

- Posts

- A Full Analysis of Cameco ($CCJ)

A Full Analysis of Cameco ($CCJ)

It's time to discuss the world's largest publicly traded uranium company.

Hi everyone,

Welcome back to another edition of Grit Alpha! This week, we’re diving into a major player in the uranium space — fueling the nuclear energy frenzy.

Stock Deep Dive: Cameco Corp. (CCJ-US, $46B MCAP)

There is a famous saying in investing that you should “skate to where the puck is going.”

For those of you who are not hockey players — this means you need to be investing for timelines that are going to evolve over the next 18-24 months. This is all about spotting these mid-long term secular trends and positioning yourself ahead of them.

AI is everywhere right now and the market is well aware of the playing these names through the MAG7, especially Nvidia.

But we’re also undergoing a renaissance in the energy sector in order to power these massive data centers.

A lot of players in the ecosystem believe that the short-term bottleneck is going to be energy.

Currently, many of these data centers are powered with natural gas, but we need much more power.

The US government knows this too. There recently was a landmark deal involving several key players to build out the next evolution of power: nuclear energy.

In this issue, I’m going to cover one of the largest raw material suppliers to this theme.

Why now? 👉 New $80B Deal with US Government

Overview 👉 What Does Cameco Do?

Role in Ecosystem 👉 How Uranium Fits into Nuclear

How Do They Win? 👉 Value Proposition

Business Units 👉 Segment Breakdown

How Do They Make Money? 👉 Revenue Model

By The Numbers 👉 Key Metrics

Competition and Outlook 👉 Navigating a Nuclear Renaissance

Risks 👉 Potential Pitfalls

Why now? 👉 New $80B Deal with US Government

Cameco finds itself at the center of a historic nuclear revival. The U.S. government just unveiled an $80 billion strategic partnership with reactor-maker Westinghouse, Cameco, and Brookfield to construct a fleet of new nuclear power plants across the country. This program, focused on Westinghouse AP1000 reactors, is slated to create over 100,000 jobs and cement nuclear energy’s role in powering energy-hungry data centers and AI infrastructure.

For Cameco, the deal is transformative. It virtually guarantees surging demand for its uranium fuel over the coming decades, backed by government financing and a newfound bipartisan enthusiasm for nuclear power as “the baseload electrical power source of the future”.

Investors are taking notice as nuclear energy gains favor as a strategic, recession-resistant sector. Unlike more volatile energy industries, nuclear power boasts decades-long projects and government-backed contracts that aren’t easily derailed by economic swings. Cameco’s unique position gives it an almost “oasis-like” resilience in uncertain times. On top of that, management’s bold moves (like partnering to acquire Westinghouse) signal that Cameco aims to evolve from a pure miner into a vertically integrated nuclear powerhouse.

The world is pivoting back to atomic energy to meet its twin goals of energy security and carbon-free power, and Cameco is at the forefront of this shift. The confluence of massive public-private investment, surging uranium prices, and ambitious expansion plans underscores that this moment is a pivotal inflection point for Cameco’s future growth. Tier-one assets + nuclear tailwinds = a potential powerhouse in the making.

Overview 👉 What Does Cameco Do?

Source: Company Filings

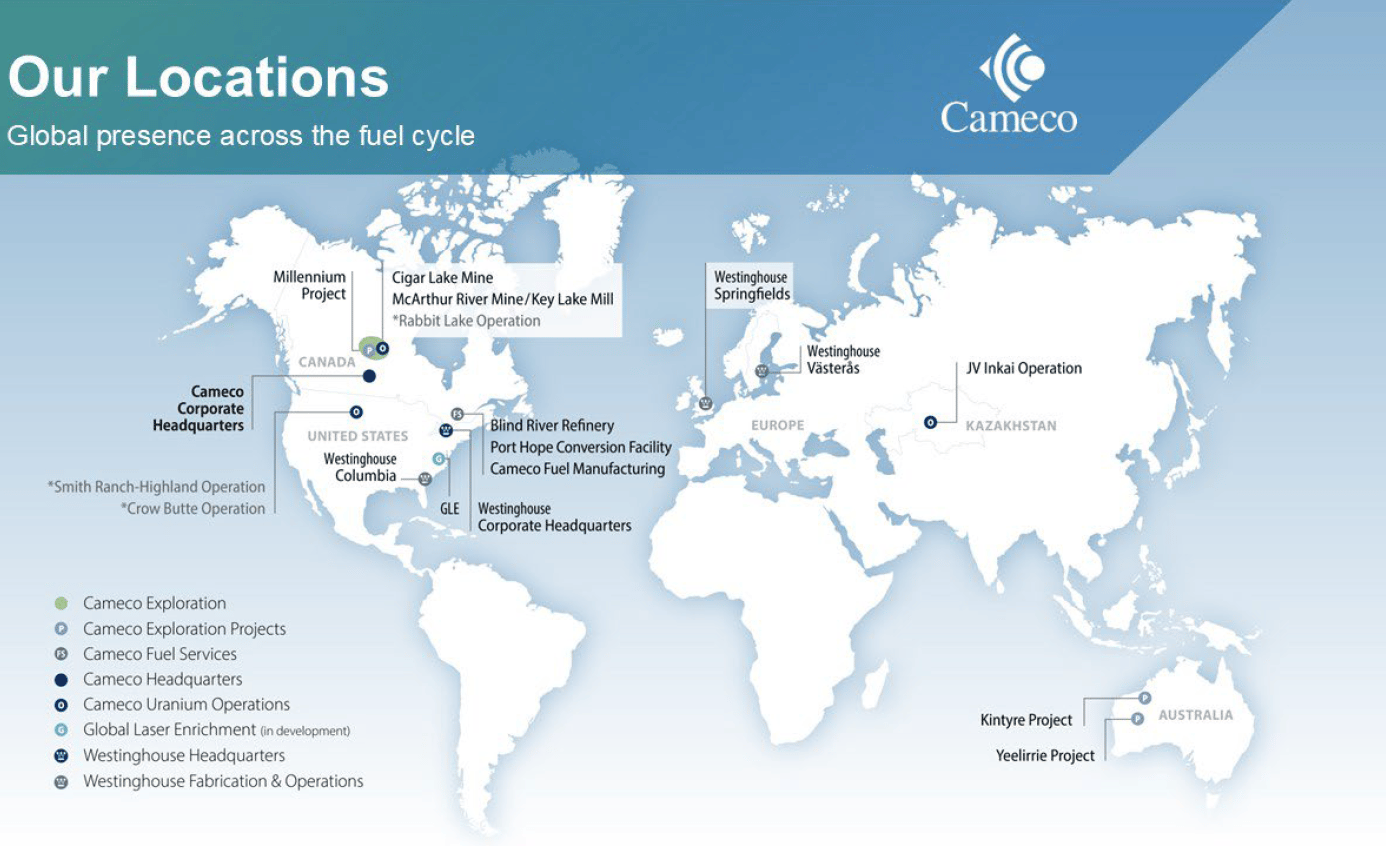

Cameco is a leader in the nuclear fuel supply chain and a top uranium producer. Founded in 1988 in Saskatchewan, it operates tier-one mines in Canada’s Athabasca Basin, including McArthur River and Cigar Lake, with the highest grades globally. Core business: discover and mine uranium (U3O8), then refine and convert it into fuel forms utilities buy to generate electricity.

Historically, Cameco has supplied roughly 15-20% of global uranium, powering reactors across North America, Europe, and Asia. Beyond mining, Cameco runs refining and conversion facilities in Ontario that produce uranium hexafluoride gas and uranium dioxide powder, intermediary products for enrichment and fuel fabrication. The company also owns 49% of Westinghouse Electric Company, extending its reach into reactor technology and services. As nations seek reliable, carbon-free baseload power, Cameco’s integration from ore to fuel services makes it a crucial pillar of the energy transition around the world today.